Real versus nominal value (economics)

| Part of a series on |

| Economics |

|---|

|

|

|

By application |

Notable economists |

Lists |

Glossary |

|

In economics, a real value of a good or other entity has been adjusted for inflation, enabling comparison of quantities as if prices had not changed. Changes in real terms therefore exclude the effect of inflation. In contrast with a real value, a nominal value has not been adjusted for inflation, and so changes in nominal value reflect at least in part the effect of inflation.

Contents

1 Prices and inflation

2 Real value

3 Real growth rate

4 Real wages and real gross domestic product

5 Example

6 Real interest rates

7 Cross-sectional comparison

8 See also

9 Notes

10 References

11 External links

Prices and inflation

A representative collection of goods, or commodity bundle, is used for comparison purposes, to measure inflation. The nominal (unadjusted) value of the commodity bundle in a given year depends on prices current at the time, whereas the real value of the commodity bundle, if it is truly representative, remains the same. The real values of individual goods or commodities may rise or fall against each other, in relative terms, but a representative commodity bundle as a whole retains its real value as a constant over time.

A price index is calculated relative to a base year. Indices are typically normalized at 100 in the base year. Starting from a base (or reference) year, a price index Pt represents the price of the commodity bundle over time t. In base year zero, P0 is set to 100. If for example the base year is 1992, real values are expressed in constant 1992 dollars, with the price level defined as 100 for 1992. If, for example, the price of the commodity bundle has increased in the first year by 1%, then Pt rises from P0 = 100 to P1 = 101.

The inflation rate it{displaystyle i_{t}}

- change in price / price in year t - 1

- =Pt−Pt−1Pt−1{displaystyle ={frac {P_{t}-P_{t-1}}{P_{t-1}}}}

- =PtPt−1−1{displaystyle ={frac {P_{t}}{P_{t-1}}}-1}

Real value

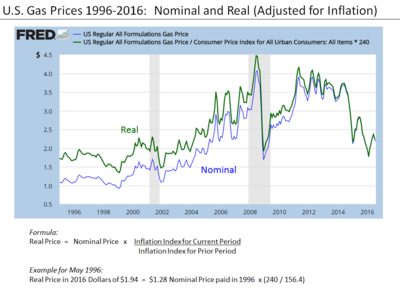

Comparison of real and nominal gas prices 1996 to 2016, illustrating the formula for conversion. Here the base year is 2016.

The price index is applied to adjust the nominal value Q of a quantity, such as wages or total production, to obtain its real value. The real value is the value expressed in terms of purchasing power in the base year.

The index price divided by its base-year value, Pt/P0,{displaystyle P_{t}/P_{0},}

Real values can be found by dividing the nominal value by the growth factor of a price index. Using the price index growth factor as a divisor for converting a nominal value into a real value, the real value in year t relative to the base year 0 is:

- P0⋅QtPt{displaystyle {frac {P_{0}cdot Q_{t}}{P_{t}}}}

Real growth rate

The real growth rate rt{displaystyle r_{t}}

- rt=P0⋅QtPt/P0⋅Qt−1Pt−1−1{displaystyle r_{t}={frac {P_{0}cdot Q_{t}}{P_{t}}}/{frac {P_{0}cdot Q_{t-1}}{P_{t-1}}}-1}

- =Pt−1⋅QtPt⋅Qt−1−1{displaystyle ={frac {P_{t-1}cdot Q_{t}}{P_{t}cdot Q_{t-1}}}-1}

- =Pt−1⋅QtPt⋅Qt−1−1{displaystyle ={frac {P_{t-1}cdot Q_{t}}{P_{t}cdot Q_{t-1}}}-1}

- =QtQt−1/PtPt−1−1{displaystyle ={frac {Q_{t}}{Q_{t-1}}}/{frac {P_{t}}{P_{t-1}}}-1}

- =QtQt−1/PtPt−1−1{displaystyle ={frac {Q_{t}}{Q_{t-1}}}/{frac {P_{t}}{P_{t-1}}}-1}

- =1+gt1+it−1{displaystyle ={frac {1+g_{t}}{1+i_{t}}}-1}

- =1+gt1+it−1{displaystyle ={frac {1+g_{t}}{1+i_{t}}}-1}

where:

gt{displaystyle g_{t}}is the nominal growth rate of Qt{displaystyle Q_{t}}

,

and:

it{displaystyle i_{t}}is the inflation rate.

- 1+rt=1+gt1+it{displaystyle 1+r_{t}={frac {1+g_{t}}{1+i_{t}}}}

For values of it{displaystyle i_{t}}

- (1+it)−1=1−it+it2−it3+...{displaystyle (1+i_{t})^{-1}=1-i_{t}+i_{t}^{2}-i_{t}^{3}+...}

so

- 1+rt=(1+gt)(1−it+it2−it3+...){displaystyle 1+r_{t}=(1+g_{t})(1-i_{t}+i_{t}^{2}-i_{t}^{3}+...)}

- =1+gt−it−gtit+it2+higher order terms.{displaystyle =1+g_{t}-i_{t}-g_{t}i_{t}+i_{t}^{2}+{text{higher order terms.}}}

- =1+gt−it−gtit+it2+higher order terms.{displaystyle =1+g_{t}-i_{t}-g_{t}i_{t}+i_{t}^{2}+{text{higher order terms.}}}

Hence as a first-order (i.e. linear) approximation,

- rt=gt−it{displaystyle r_{t}=g_{t}-i_{t}}

Real wages and real gross domestic product

The bundle of goods used to measure the Consumer Price Index (CPI) is applicable to consumers. So for wage earners as consumers, an appropriate way to measure real wages is to divide the nominal wage (after-tax) by the growth factor in the CPI.

Gross domestic product (GDP) is a measure of aggregate output. Nominal GDP in a particular period reflects prices which were current at the time, whereas real GDP compensates for inflation. Price indices and the U.S. National Income and Product Accounts are constructed from bundles of commodities and their respective prices. In the case of GDP, a suitable price index is the GDP price index. In the U.S. National Income and Product Accounts, nominal GDP is called GDP in current dollars (that is, in prices current for each designated year), and real GDP is called GDP in [base-year] dollars (that is, in dollars that can purchase the same quantity of commodities as in the base year).

Example

If for years 1 and 2 (possibly a span of 20 years apart), the nominal wage and price level P of goods are respectively

then real wages using year 1 as the base year are respectively:

The real wage each year measures the buying power of the hourly wage in common terms. In this example, the real wage rate increased by 20 percent, meaning that an hour's wage would buy 20% more goods in year 2 compared with year 1. |

Real interest rates

As was shown in the section above on the real growth rate,

- 1+rt=1+gt1+it{displaystyle 1+r_{t}={frac {1+g_{t}}{1+i_{t}}}}

where

rt{displaystyle r_{t}}is the rate of increase of a quantity in real terms,

gt{displaystyle g_{t}}is the rate of increase of the same quantity in nominal terms, and

it{displaystyle i_{t}}is the rate of inflation,

and as a first-order approximation,

- rt=gt−it.{displaystyle r_{t}=g_{t}-i_{t}.}

In the case where the growing quantity is a financial asset, gt{displaystyle g_{t}}

Looking back into the past, the ex post real interest rate is approximately the historical nominal interest rate minus inflation. Looking forward into the future, the expected real interest rate is approximately the nominal interest rate minus the expected inflation rate.

Cross-sectional comparison

Not only time-series data, as above, but also cross-section data which depends on prices which may vary geographically for example, can be adjusted in a similar way. For example, the total value of a good produced in a region of a country depends on both the amount and the price. To compare the output of different regions, the nominal output in a region can be adjusted by repricing the goods at common or average prices.

See also

- Aggregation problem

- Classical dichotomy

- Constant Item Purchasing Power Accounting

- Cost-of-living index

- Deflation

- Financial repression

- Index (economics)

- Inflation

- Inflation accounting

- Interest

- Money illusion

- National accounts

- Neutrality of money

- Numéraire

- Real interest rate

- Real prices and ideal prices

Template:Inflation – for price conversions in Wikipedia articles

Notes

^ Benninga, Simon; Oded Sarig (1997). Corporate Finance: A Valuation Approach. The McGraw-Hill Companies. p. 21. ISBN 0-07-005099-6..mw-parser-output cite.citation{font-style:inherit}.mw-parser-output .citation q{quotes:"""""""'""'"}.mw-parser-output .citation .cs1-lock-free a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/6/65/Lock-green.svg/9px-Lock-green.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .citation .cs1-lock-limited a,.mw-parser-output .citation .cs1-lock-registration a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/d/d6/Lock-gray-alt-2.svg/9px-Lock-gray-alt-2.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .citation .cs1-lock-subscription a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/a/aa/Lock-red-alt-2.svg/9px-Lock-red-alt-2.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration{color:#555}.mw-parser-output .cs1-subscription span,.mw-parser-output .cs1-registration span{border-bottom:1px dotted;cursor:help}.mw-parser-output .cs1-ws-icon a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/4/4c/Wikisource-logo.svg/12px-Wikisource-logo.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output code.cs1-code{color:inherit;background:inherit;border:inherit;padding:inherit}.mw-parser-output .cs1-hidden-error{display:none;font-size:100%}.mw-parser-output .cs1-visible-error{font-size:100%}.mw-parser-output .cs1-maint{display:none;color:#33aa33;margin-left:0.3em}.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration,.mw-parser-output .cs1-format{font-size:95%}.mw-parser-output .cs1-kern-left,.mw-parser-output .cs1-kern-wl-left{padding-left:0.2em}.mw-parser-output .cs1-kern-right,.mw-parser-output .cs1-kern-wl-right{padding-right:0.2em}

[1]

References

- W.E. Diewert, "index numbers," ([1987] 2008)The New Palgrave Dictionary of Economics, 2nd ed. Abstract.

- R. O'Donnell (1987). "real and nominal quantities," The New Palgrave: A Dictionary of Economics, v. 4, pp. 97–98 (Adam Smith's early distinction vindicated)

Amartya Sen (1979). "The Welfare Basis of Real Income Comparisons: A Survey," Journal of Economic Literature, 17(1), p p. 1-45.- D. Usher (1987). "real income," The New Palgrave: A Dictionary of Economics, v. 4, pp. 104–05

External links

DataBasics: Deflating Nominal Values to Real Values from Federal Reserve Bank of Dallas

CPI Inflation Calculator from U.S. Bureau of Labor Statistics